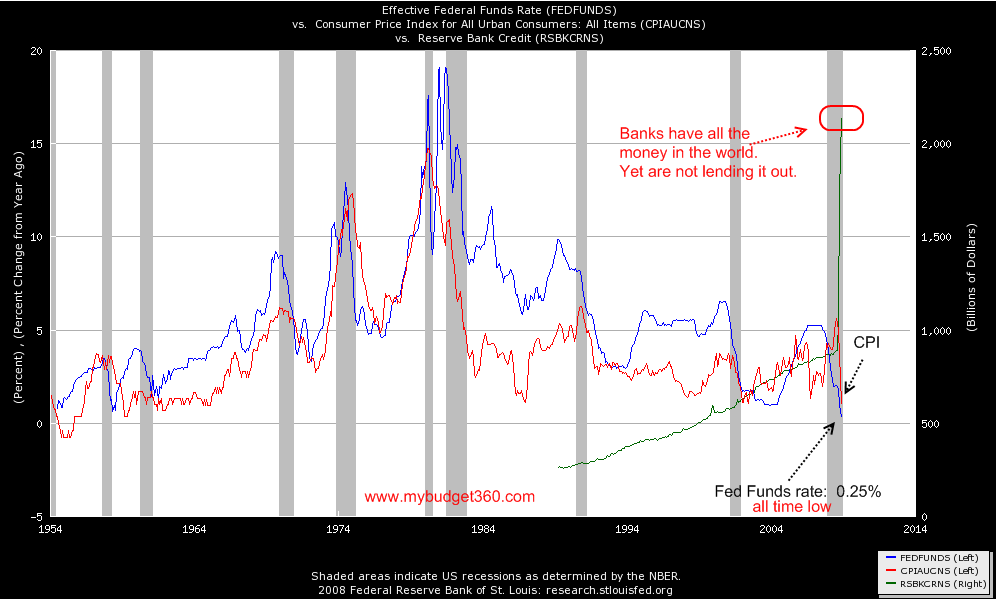

Tuesday’s action by the Federal Reserve has placed us into the history books. The Fed cut the federal funds rate to an unprecedented 0.25% and gave a rather firm statement that they are prepared to keep the rate at this low level as long as the markets deem it necessary. When asked why they didn’t cut rates down to 0 a Fed official replied that it would help the credit markets run more smoothly. The markets don’t believe that. In fact, the markets have been trading near the zero percent mark for some time now.

As the market volatility has increased causing 2008 to be one of the most volatile years on record, we are seeing some historical action occur. First, let us look at 3 key economic indicators:

*Click for sharper image

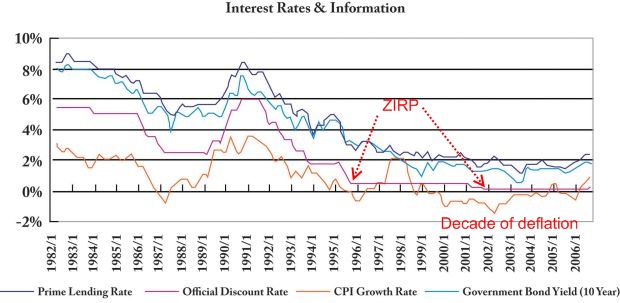

Let me try to walk you through a few things here. First, the federal funds rate is now sitting at a historic low. We are now seeing a zero interest rate policy regardless of what the Fed is saying. The fact the rate was left at 0.25 is merely symbolic. What the move signals is the Fed is basically done with monetary measures. It has no choice. It has reached the bottom of the barrel.

What led it to the bottom of the barrel is how quickly the red line on the chart above is shooting lower, consumer inflation. Some are trying to call it “dis-inflation” but let us be honest, this is deflation. This is scaring the Fed into doing unprecedented things. So why is this deflation? Let us count the ways:

(a) Housing market is imploding taking prices down

(b) Employment is skyrocketing keeping wages stagnant for many and wiping out income for others

(c) Stock markets are tanking across the globe. With nearly $50 trillion in global wealth lost in one year.

There is nothing remotely close to calling this inflation. In fact, the CPI released fell the most on a monthly basis in 61 years. In fact, this was off the charts since the BLS started keeping track of this data point in 1947. It dropped 1.7 percent in November. Compound that with the 1 percent drop in October and you can quickly see that we are quickly approaching a year over year percent drop on the CPI. The last time the CPI dropped on a year over year basis was in the early 1950s as you can see from the chart above.

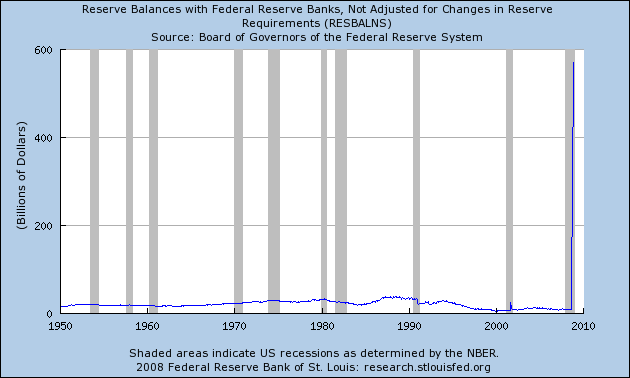

The other point on the chart is the reserve bank credit which is over $2.2 trillion. Now some may argue that this is inflationary. It is only inflationary if it makes its way into the hands of Joe and Susie public and that is not happening. How can we tell? Because when we look at reserve bank credit which includes much of the bailout funds, banks are pouring them into treasuries and sitting tight:

This is unprecedented. Banks are scared witless to lend because of the grim reality of all the losses they will face in subsequent quarters. In fact, most banks are simply gearing up for a long economic winter and bailout funds are being used as a cushion. The blame does fall with banks but what did one expect with the Treasury lending banks money and at the same time expecting banks to lend with stricter standards? It was a losing proposition from day one. Why? First, the massive credit boom of the last 30 years was dependent on a healthy employment base and lax credit. Now, we have the exact opposite. We have a quickly deteriorating employment picture and banks are expected to be more strict in lending money.

The only way credit will flow again as it once did is for someone to become the large non-prime lender. Wall Street and foreign banks took up that role gladly during this decade. Now, the only entity with enough power to fill that role is the government. The Federal Reserve in conjunction with the U.S. Treasury are attempting to become the biggest non-prime lender of all time. Consider that 0.25 a teaser rate for a future of economic trouble.

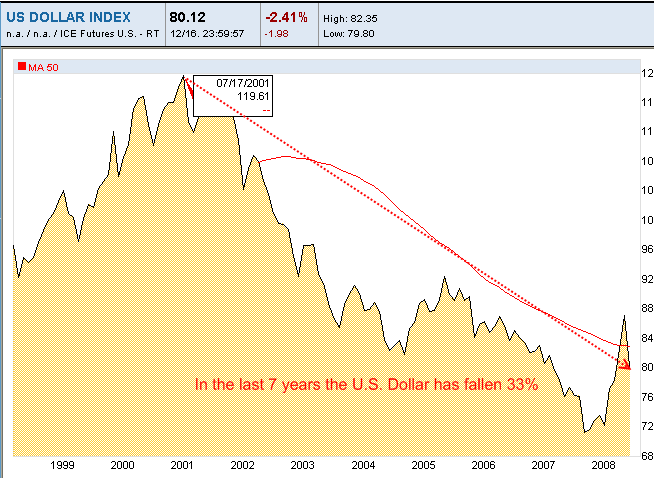

It sometimes helps to see what is being sacrificed here. The first major casualty is the U.S. Dollar which got pummeled by the Fed rate cut:

The U.S. Dollar has been in a steady decline. That is, until early summer of this year when it started a ferocious rally. What occurred near this time? A few things. Global decoupling was laid to rest and the oil bubble burst. Massive deleveraging led investors to a common resting spot. The U.S. Dollar. Keep in mind the one thing we are not hearing anyone talk about is a strong dollar policy. Why? Because it wouldn’t sound too good to the American public if the Fed stated that they were systematically trying to destroy the value of the U.S. Dollar on the global exchange markets. Why? Well, unfortunately the massive amount of debt which amounts to approximately $49 trillion in the U.S. is simply back breaking. The Fed is desperately going to do anything it can to bring back inflation even if it means an all out war on the U.S. Dollar. You need only look at the chart above to see what is happening.

Anyone that has traveled abroad realizes the destruction of the U.S. Dollar. Let us take a longer view of this and you will understand why:

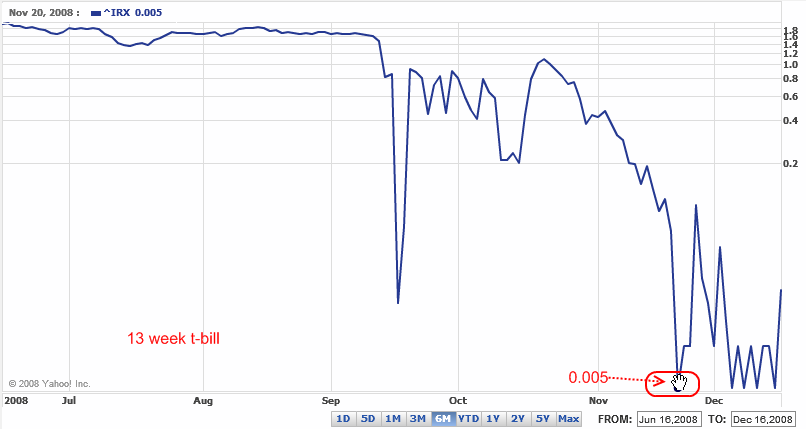

In the last 7 years the U.S. dollar has fallen a stunning 33 percent. In global terms we are steadily getting poorer and poorer and the Fed and U.S. Treasury are happy to oblige. You need to remember that it would be very easy for the Fed to strengthen the dollar. All they need to do is increase the fed funds rate to encourage saving. Yet the only people that are saving right now are foreigners and many are happy to invest at 0 percent rates of return:

Is this even good for our country? It depends if you enjoy a weak dollar that is systematically being attacked. The Fed is desperately trying to engineer inflation to get us out of our massive debt. Remember that in deflation debt is the worst possible thing to have. The reason for this is asset values are declining while the face value of the note remains the same. Housing is a perfect example. Say you bought a home for $500,000 and took out a $450,000 mortgage. The home is now worth $300,000. A current buyer purchase a similar home for $300,000 today and takes out a $250,000 note. You have a $450,000 mortgage still and the new buyer has a mortgage $200,000 cheaper than the one you have. Now multiply that over thousands of times. Deflation is to be avoided at all cost because it renders the Fed a wizard behind the curtain (at least that is what they hope to avoid).

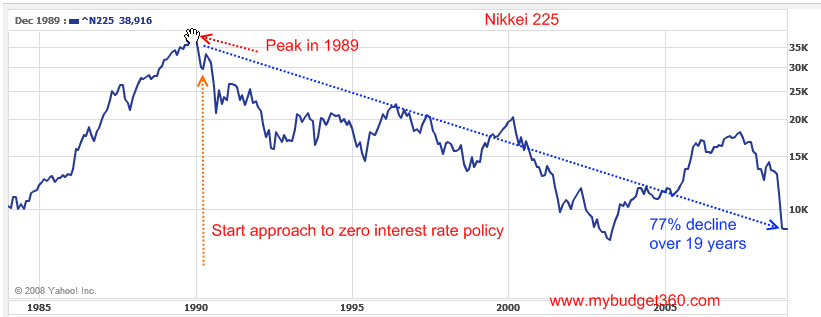

It may be worthwhile to take a look at Japan since they went down a similar path:

They followed a zero interest rate policy and injected billions into their banks after their real estate market bubble collapsed and their stock market burst. If you take a look at the chart above, the Bank of Japan systematically started cutting rates in the early 1990s and has held them low ever since. Nearly 2 decades after. How did this help their stock market and real estate market?

I remember when this argument was made in the initial days how quickly it was brushed off. We are not Japan echoed the argument. That is true. We are different in many ways. Yet we have similar circumstances especially in our financial markets. Let us outline at least the similarities and you judge for yourself:

(a) Massive unsustainable real estate bubble

(b) Lax lending standards

(c) Over building

(d) Massive stock market bubble

(e) Stock market and real estate bubbles burst together

(f) Japanese government injects liquidity into banks

(g) Bank of Japan cuts official discount rate to near zero

(h) Start of deflation

We’re playing out the same scenario above. Sure, Japan is different culturally and in many other ways but a through h above are essentially what we are living. That is simply a fact. We had a real estate bubble and stock market bubble burst together. We had horrifically bad lending standards. There was massive over building in real estate. Our government is now injecting capital into banks. Our Federal Reserve is approaching the zero interest rate policy. We are now seeing a taste of deflation.

The only ace in the hole is that the Fed is trying all these other creative instruments to get credit going again. You know what is the only thing that will work? The only way this will work is if the Fed and U.S. Treasury nationalize all banks and enforce lax lending standards and bring back the bubble days. That way, they can directly oversee how the funds are being disbursed. Otherwise, banks privy enough to get a cut of the bailout funds will sit comfortably looking for deals as banks not on the bailout list implode. Next year we know that we will be seeing massive fiscal stimulus and it is hard to say how the market is going to react to an aggressive Fed while the government becomes the number spender. We’ve never been down this road before.

Yet the major losers here are those who are prudent and savers. If you look at savings rates at your local banks, you are looking at another zero interest rate policy. The notion of dollar cost averaging into the stock market has gone out the window for probably a generation. If we were to go back to historical rates of 5 to 6 percent many savers would start storing money especially given the current economic shock. Yet we are doing the opposite. The Fed now is trying to make rates so low that banks will be forced to lend. Yet here is the kicker. A bank would rather have a 0 percent rate of return than a certain loss to a bad borrower.

I mourn for the U.S. Dollar primarily. It is a very tough time to be a saver with our current Fed and U.S. Treasury destined to annihilate our once mighty greenback.

No comments:

Post a Comment