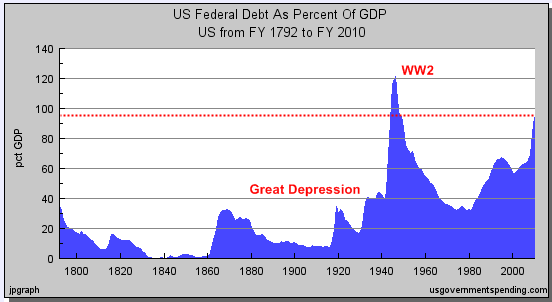

People may not even realize that during the Great Depression, US Federal debt as a percent of GDP did not even reach 40 percent. Part of this was because the size of government was much smaller in military, public services, and entitlements. The only time in history that the US as a whole spent more than it produced was during World War II. That is the only time but we are now quickly approaching the 100 percent range of federal debt to GDP as a percentage. The US Treasury and Federal Reserve are aiming to pull the economy out of the Great Recession by going into further debt. Think about this for a few minutes. What led the US into a major financial crisis were banks allowing people to go into too much debt buying homes, cars, and other things they clearly were not able to afford. While the banks were bailed out courtesy of taxpayers, the central banks are aiming to go deeper into debt just to create additional bubbles. Bankers are loving this and their profits reflect this change. Yet as many chastise economies around the world for going too deep into debt it is likely we will hit the 100 percent threshold next year.

Take a look at the amount of debt relative to our nation’s production:

Does the above even look healthy to you? Starting in the 1970s the US government thought it would be smart to simply “deficit spend” and put all expenses on the US credit card. So for a few decades this worked but now what? If debt was the solution to everything then why not give every American an open ended credit card with $1 million dollars pre-loaded? It would be simple given most Americans already have a credit card. Yet wealth is reflected by what can actually be produced and the Federal Reserve simply printing money dilutes the currency of the US. Common sense would tell you this.

Read the entire report

No comments:

Post a Comment