June 12, 2021

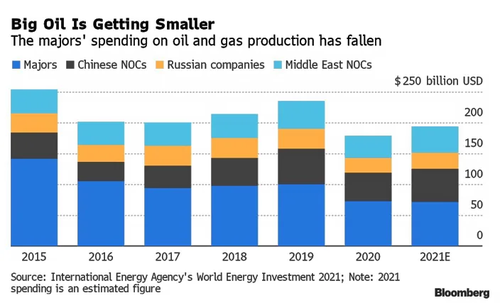

Despite the activist shareholder battles, calls for ESG changes and just outright negative press about fossil fuels, it looks like rumors of oil's death have been greatly exaggerated. Fossil fuels aren't dying - rather, their output is just being shifted to national and state owned companies.

Even as the supermajor oil companies shrink in size and adhere to incessant criticism, fossil-fuel demand holds strong, according to Yahoo Finance. Activists have been the busiest they have been in years...

Recent weeks saw Exxon and Chevron rebuked by their own shareholders over climate concerns, while Shell lost a lawsuit in the Hague over the pace of its shift away from oil and gas.

...and this has been a tailwind for national oil companies (NOCs) and state owned players who aren't under the same pressure to play ball with activists. The report notes that "Saudi Aramco and Abu Dhabi National Oil Co. are spending billions to boost their respective output capacities", as is Qatar Petroleum.

NOC's share of global oil output is expected to rise to 65%, from about 50% today, by 2050. Companies like Exxon and Chevron are keeping output at lows and curtailing future investment in traditional oil and gas infrastructure.

Patrick Heller, an adviser at the Natural Resource Governance Institute, told Yahoo Finance: “We hear government officials and NOC officials say, ‘We look at the divestment of international oil companies from some projects as an opportunity for us to grow. And I do think that’s potentially really risky.”

Jason Bordoff, director of the Center on Global Energy Policy at Columbia University’s School of International and Public Affairs, thinks that the shift to government owners could wind up doing just the opposite of what activists are intending on doing.

"A shift in production to major nationally owned companies — such as in Latin America or the Gulf or Russia — carries geopolitical supply risks, while smaller independents have often demonstrated poorer safety and environmental practices,” he said.

And emissions and carbon footprints from NOCs will eventually need to be addressed.

“NOCs are sort of the biggest keys when it comes to looking at country-level emissions. It’s easy to see how taking action on NOC emissions, especially methane, will yield pretty quick and more effective climate results,” Ratnika Prasad, director of energy strategy at the Environmental Defense Fund, said.

Recall, just days ago we wrote how Saudi and Russian oil producers were actually benefitting from activism in the industry involving Western producers. Wins in the courtroom for activists against Shell, Chevron and Exxon have been a tailwind for Saudi Aramco, Abu Dhabi National Oil Co and Gazprom, we wrote. The pressure for U.S. names to cut carbon emissions faster pushes more business to companies in Saudi Arabia and Russia, and to OPEC, Reuters reported.

Among the recent wins was a Dutch court ruling that required Shell to "drastically cut emissions". Exxon and Chevron also both activist battles with shareholders who have accused the giants of not being proactive enough in addressing climate change.

Amrita Sen from consultancy Energy Aspects said: “Oil and gas demand is far from peaking and supplies will be needed, but international oil companies will not be allowed to invest in this environment, meaning national oil companies have to step in.”

The Saudis, meanwhile, don't seem quite as alarmed by the issue of climate change. When The International Energy Agency issued guidance last month to scrap all new oil and gas developments, Saudi Energy Minister Prince Abdulaziz bin Salman responded by stating:

"It (the IEA report) is a sequel of the La La Land movie. Why should I take it seriously? We (Saudi Arabia) are ... producing oil and gas at low cost and producing renewables. I urge the world to accept this as a reality: that we’re going to be winners of all of these activities."

A spokesperson from Gazprom jabbed: "It looks like the West will have to rely more on what it calls 'hostile regimes' for its supply".

"Western oil majors like Shell have dramatically expanded in the last 50 years" as a result of the West trying to cut reliance on Middle Eastern and Russian oil, Reuters notes. Now these producers must balance a growing chorus of criticisms about climate change with continued output.

Nick Stansbury at Legal & General, which manages $1.8 trillion, said: "It is vital that the global oil industry aligns its production to the Paris goals. But that must be done in step with policy, changes to the demand side, and the rebuilding of the world’s energy system. Forcing one company to do so in the courts may (if it is effective at all) only result in higher prices and foregone profits."

While Saudi Arabia claims to have targets to cut carbon emissions, it isn't beholden to U.N.-backed targets or activist investors like Western companies are. Gazprom has indicated a shift to natural gas to try and manage its carbon emissions.

Western names account for about 15% of all output globally, while Russia and OPEC make up about 40%. At the same time, global oil consumption has risen to 100 million barrels per day from 65 million barrels per day in 1990.

“The same oil and gas will still be produced. Just with lower ESG standards,” one Middle Eastern oil executive concluded.